What Is A Balance Sheet And Why Do I Need One?

What Is A Balance Sheet And Why Do I Need One?

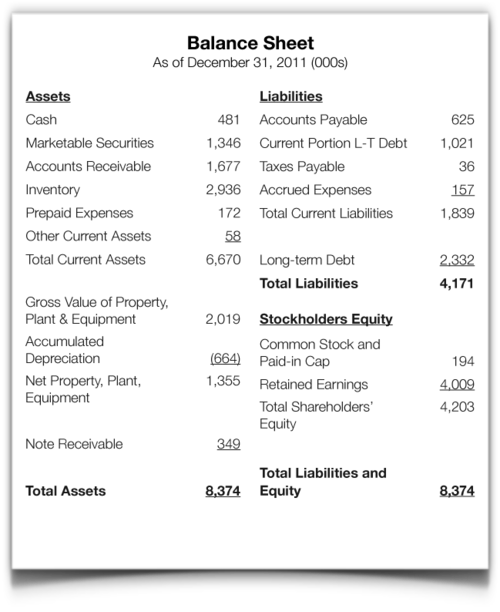

As the owner of a business, whether large or small, it’s important to know at all times where your business stands financially. As you think about investments, hiring, production, or any myriad of important decisions you must do so with a clear sense of exactly the financial position your business is currently in. This is where the balance sheet comes into play. A balance sheet is an up-to-the-moment snapshot of all of your company’s assets and liabilities. Generally, the balance sheet looks like the example to the right, with assets in a column on the left, and liabilities and shareholders equity in a column on the right.

The purpose of this balance sheet is to give you current financial information about your company so that you can make the best decisions for your future.

The assets column in the balance sheet is the combination of all your assets including cash accounts, money owed to you by customers, your inventory, and the value of your property and equipment. The liabilities section should include all money that is owed to other companies, unpaid taxes, and any other debts. Below that section you will list your stockholders equity which is the book value of the company including money invested by stockholders and money that is made and retained by the company each year. At the end of your balance sheet, your assets must balance against the combined values of your liabilities and the shareholders equity. In layman's terms, the amount of money you’re making must be equal to amount you’re paying out combined with the amount you’re keeping in the business. Otherwise your accounting is off somewhere.

So why do you need a balance sheet of your own?

Very simply, you must be aware at all times of the health of your company. Just as with your personal finances, if you’re spending more than you’re making you’ll be in financial trouble fairly quickly.

In addition to staying on top of your bills so that you don’t underspend, a good balance sheet will help you determine whether or not you’re investing enough money back into your business. If you have lots of excess, perhaps it’s time to expand.

Are you thinking about selling? It’s important that you know the exact value of your business so that you can share it with potential buyers.

If you’re new to your business and are looking for a way to formalize your finances and bring your company up to the next level, work together with your bookkeeper and accountant to compile all of your financial information into a balance sheet that gives you real-time financial information. Having this information available and at hand will empower you to make the best decisions for the health of your company and your employees. If you’re in the market for an accountant to help envision the future of your business, contact us today.